It’s Here!

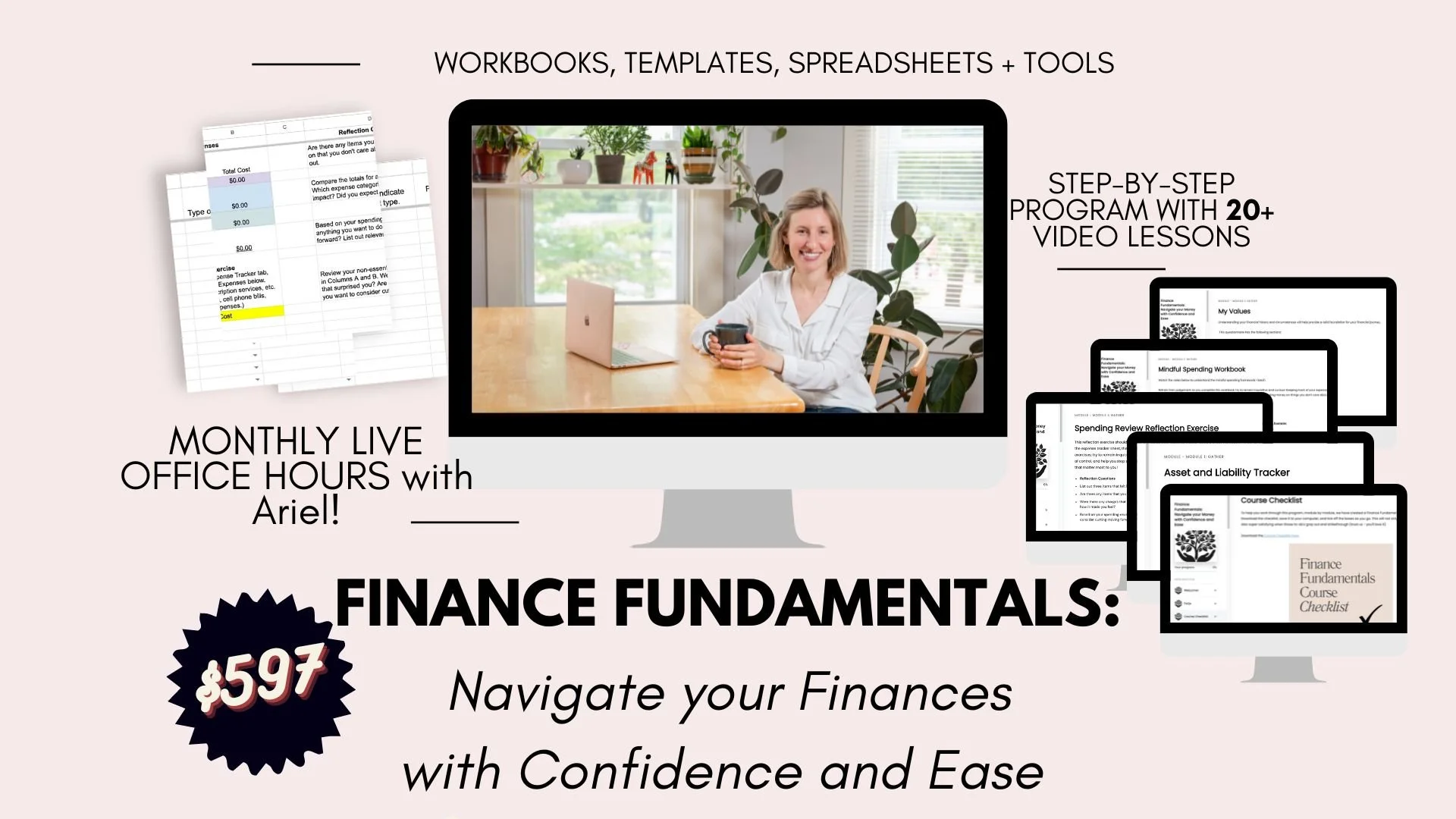

Finance Fundamentals the Course:

Navigate your Money with Confidence and Ease

Introducing the online course…

Finance Fundamentals:

Navigate your Money with Confidence and Ease

Limited Time Founding Members Offer

✔️ 20% off with code FOUNDER20

✔️ Monthly Office Hours with Ariel

✔️ Up-to-Date Lesson Content Dropped weekly

Let me know if this is you….

Unsure about where your money should be and what it should be doing?

High-yield savings account? Cash? Investments?

Unclear about what financial goals you should be working towards?

How much is “enough” retirement savings?

Guilt-ridden over self-care expenses or buying that latte?

Ashamed you are too old/too young to not have a financial plan?

Confused about how to prioritize your financial goals?

Ready for a change?

I want to show you a new path forward.

What if you felt empowered by your money?

What if thinking about your financial future made you feel calm and confident?

That’s not the world most of us live in. But with guidance, I know you can get there!

![“Every aspect of my life suffered because of my finances[…]

100% worth the investment.”](https://images.squarespace-cdn.com/content/v1/5ea07850c1a8f3764ccd6d6d/8f5f8456-0346-4487-8171-8f5b537cbcc6/QuotesReviews++%28IG+Post%29+%2824%29.jpg)

“Every aspect of my life suffered because of my finances[…]100% worth the investment.”

— Catherine

“I had a seismic shift for the better.”

— Ashley

Watch the video

Finance Fundamentals is a hands-on, step-by-step video course that equips you with tools, guidance, and support to navigate your money with confidence and ease.

Let’s break it down.

-

Module 1: Gather

In this module you will assess where you are financially and emotionally with your money.

~ Build a clear picture of your money expenses and money history.

~ Understand your current financial picture so you can get to where you want to go.

~ Gain awareness of how you spend your money.

~Identify your core values and reflect on how money can support the life you want!

Founding members get instant access to Module 1.

-

Module 2: Learn

In this module you will learn core financial principals in easily digestible and fun formats.

~ Understand investing basics, retirement factors, savings vehicles, and more.

~ Learn a practical budget framework to organize your finances.

~ Say goodbye to patronizing financial advice, hello to financial confidence.

~ Explore a fresh financial perspective!

Founding members get content lessons for Module 2 dropped live weekly.

-

Module 3: Apply

In this module you will apply the core financial learnings to your specific needs and circumstances.

~ Take control of your individual retirement needs and the relevant factors.

~ Gain clarity of your financial goals and how money can help you live the life you want.

~ Create a purpose-driven plan for your financial accounts.

~ If applicable, outline a sustainable approach to manage debt.

Founding members get content lessons for Module 3 dropped live weekly.

-

Module 4: Action and Accountability

In this module you will set yourself up for long-term success with concrete, tangible steps and accountability tools.

~ Gain confidence in your ability to reach your financial goals.

~ Feel at ease with your spending.

~ Have a clear path with tangible steps to ensure you are in control of your financial future!

Founding members get content lessons for Module 4 dropped live weekly.

“Aside from being deeply knowledgeable, Ariel is also super kind, patient, and encouraging at every step of the way.”

— Yasmine

“I no longer adopt an ostrich approach to my finances.”

— Hannah

Hi, I’m Ariel.

I come to this work as a feminist and Certified Financial Education Instructor℠. I previously worked as a senior executive at a software company, and I studied economics (and as it happens, art history) at Wellesley College. Finances for Feminists was born at the height of the pandemic when financial stress and uncertainty was at a record peak.

I work with clients to address emotional and tactical aspects of personal finance. We implement concrete action plans that change their relationship to money.

“I no longer feel physically burdened by financial stress but optimistic and hopeful about the future.”

— Nora

“[Finance Fundamentals] was one of the most life-changing things I have done.”

— Hannah

This could be you.

“It was incredibly empowering to invest in our financial future [as a couple] with someone who could guide us through the process.

— Danica

“Finances and spending can be a contentious topic for couples, but Ariel was able to deftly help us [as a couple] navigate these topics.”

— Josh

Payment Options

Choose TODAY which plan works best for you, so you can get past the starting line & into RESULTS!

SINGLE PAYMENT

✔️ Finance Fundamentals Signature Method with Core Modules 25+ value-heavy lessons, resource guides, templates, and downloads ($2000 value) Founding members get instant access to Module 1 and content dropped weekly for Modules 2-4.

✔️ LIVE Office Hours (monthly with Ariel!) ($3600 value)

✔️ Mindful Money Tracker Workbook ($150 value)

✔️ Asset Tracker and Liability Template ($150 value)

✔️ Budget Framework Worksheet ($100 value)

✔️ Money Date Checklist ($100 value)

✔️ LIFETIME access to course and all future updates for free!

*Please note lifetime access refers to the lifetime of the product.

Total Value: $6,100

Our Price: $597 USD (one-time payment)

OH! And did I mention the best part? Buy the course once, and get lifetime access— including all course updates.

MOST FLEXIBLE (payment plan)

✔️ Finance Fundamentals Signature Method with Core Modules 25+ value-heavy lessons, resource guides, templates, and downloads ($2000 value) Founding members get instant access to Module 1 and content dropped weekly for Modules 2-4.

✔️ LIVE Office Hours (monthly with Ariel!) ($3600 value)

✔️ Mindful Money Tracker Workbook ($150 value)

✔️ Asset Tracker and Liability Template ($150 value)

✔️ Budget Framework Worksheet ($100 value)

✔️ Money Date Checklist ($100 value)

✔️ LIFETIME access to course and all future updates for free!

*Please note lifetime access refers to the lifetime of the product.

Total Value: $6,100

Our Price: $299 USD Pay Monthly (2 monthly payments)

The best part? Buy the course once, and get lifetime access— including all course updates.

So…what’s so great about financial empowerment anyway?

Money is a key part of our day to day lives.

When we get a handle on our financial future, we set ourselves up for more:

choice,

freedom,

flexibility,

stability,

and control.

Wouldn’t that feel good?

“I feel self-aware and confident to navigate my finances moving forward.”

— Megan

“[Finance Fundamentals] helped me build a mental framework of my personal spending, savings, and investing habits.”

— Anne

Let’s Dig Into the Details…

Here’s exactly what you are getting.

Module 1: Gather

Founding Members get instant access to Module 1.

Complete exercises to gather information so you can assess where you are. Can’t get to where you want to go without knowing where you are first. These are action-oriented lessons, so make sure you are at your computer to complete them. Get clear on your current money picture.

My Values - A values exercise to help you explore how your money habits are aligned or misaligned with your values.

My Money History - Understand your money foundation with these key questions around Financial Communication and Support, Money Stories, Money Attitudes, and more.

Mindful Spending Workbook (spreadsheet template download) - Begin tracking your spending and practice mindful spending. Get a clear picture of your spending!

Spending Review Reflection - Use these questions to reflect on your spending patterns and habits.

Goal Visualization - A visualization exercise to ground you and tap into your inner mentor.

Asset and Liability Tracker (spreadsheet template download) - Gain clarity around your assets and liabilities and your broader financial picture.

Module One Outcomes:

I understand my core values and how they influence my money.

I have a clear map of my spending.

I have a picture of my money history and where I am coming from.

I have clarity around my assets and liabilities.

I have clarity around my current financial picture.

Module Two: Learn

Alright, now that we’ve laid a strong foundation to understand where you are coming from let’s learn the core personal personal lessons: budget framework, emergency funds, retirement and investing basics.

Founding members receive each lesson for Module 2 weekly so you get the latest content hot off the press!

50/30/20 Budget Framework - Watch this video to get a key explanation of our budget framework.

Budget Framework Part II (spreadsheet template download) - Get a handle on your competition and your audience’s needs by conducting this market analysis

Emergency Fund - Understand the importance of Emergency Funds and the factors to consider.

Retirement 101 - Get clear on why retirement matters and the tax implications.

Retirement 101 Part II - Understand the different retirement vehicles available to you.

Investment 101 Part I- Understand the core investing principles and why investing matters.

Investment 101 Part I - Learn more about stock market volatility and portfolio allocations.

Module Two Outcomes:I know exactly how my spending aligns with my savings

I can identify my savings rate.

I have a solid understanding of retirement vehicles and options.

I have a clear grasp of investing basics.

I have a stronger understanding of my savings needs and goals.

Module Three: Apply

This module's goal is for you to apply the core principles to your unique financial circumstances. Many of the lessons in this module are heavily action-oriented – we’ll get to work implementing!

Founding members receive each lesson for Module 3 weekly; hot off the press!

Income (spreadsheet download ) - Understand and calculate your income.

Debt Management: Types of Debt - If you are navigating debt these next two lessons are for you! In this lesson we’re going to outline the stages and options for debt payment strategies.

Debt Management: Approaches and Calculator - Understand the factors that go into debt repayment and calculate your timeframe and make a plan. Know your retirement needs and the relevant factors. Build a solid approach to tackle your debt!

Retirement Calculator (online calculator) - A how-to lesson and tutorial on the factors that affect your retirement savings. Calculate exactly where you are and where you need to be. Understand the amount needed to close any gaps in your savings plan.

Asset Reorganization (spreadsheet template download) - Revisits your assets to make a clear, purpose-driven plan for your specific needs and circumstances.

Slush Funds and SMART Goals: Use this framework to plan and prepare for known (or unknown!) financial goals. Get a clear picture of your financial goals and desired outcomes.

Module Three Outcomes:

I know my retirement needs and the relevant factors.

I have a clear plan for my accounts and each account has a purpose.

I have a clear picture of my financial goals and desired outcomes.

I know my income.

I have a solid approach to tackling debt.

Module Four: Accountability

This module we are setting you up for long-term success with concrete tangible steps and accountability tools. We’re in the homestretch!

Founding members receive each lesson for Module 4 weekly; hot off the press!

Core Financial Indicators - Learn how to evaluate your finances using the core financial indicators.

Action Plan Part I - This is where the rubber meets the road! Using the cumulative data and knowledge from our previous lesson, understand how to build your unique financial action plan.

Action Plan (spreadsheet template download) - Develop your core action plan building from the core financial indicators.

Automation - Decide on whether you’ll incorporate automation into your financial next steps and if so, how.

Retrospective, Reflection + Money Successes - Reflect on your journey thus far and celebrate your wins!

Money Dates- Understand the key piece to ongoing financial success. Set up money dates with yourself using this framework.

That’s a Wrap! - Celebrate your success!!

Module Four Outcomes:

I am more confident in my ability to reach my financial goals

I feel in control of my financial future

I feel more at ease with my spending

I feel more aligned with my values

I see a clear path forward and understand my financial future.

*NOTE: Founding members will receive each lesson for Module 4 weekly so you get the latest content hot off the press!

Financial wellness is a journey, not a destination.

By investing in yourself you will have the foundational knowledge and skills to build on as you continue your financial journey.

The positive habits, knowledge, and skills you've developed will set you up for long-term success.

“By the end of my time with Ariel, I barely recognized myself. I had gained confidence and knowledge…”

— Madeleine

“I needed help making informed decisions with my money.”

— Betsy

This course is for you if…

you have ever felt anxious about your finances.

you feel overwhelmed.

you are tired of patronizing financial jargon.

you are unsure where or how to start.

you want financial clarity and control.

you want to change your relationship with money.

“I was able to take years of payment off from debt.”

— Graesa

“[Finance Fundamentals] transformed my relationship to money, spending, investing, and debt.”

— Cheryl

FAQs

-

Sure, this information is out there. BUT it’s also really overwhelming. Where to start? Which steps to take and when? Who can you trust to not mansplain your frustrations away?

If you haven’t taken charge of your finances yet, you may need external accountability, support and guidance. And that’s both normal and okay!! This course uniquely blends both the emotional and analytical aspects of personal finance and gives you a clear path forward.

-

Life is busy. It feels like there is never a good time to focus on your money. This course is self-paced and self-guided which means you can fit it in on your time and schedule. Got a few minutes in the evening to yourself? Great! Grab a cozy beverage, light a candle and dive into a module. Need to go? No worries, you can pick back up wherever you left off. This course is perfect for the busy bee who needs a little extra accountability, guidance and support. If managing money is on your mind, you are already spending time worrying about it, how about you spend that time taking action instead?!

-

100%, yes. This course will help you understand and make a plan to payoff your debt without shame or judgement. Your life does not need to be put on hold while you navigate debt. Finance Fundamentals will teach you how to create a sustainable plan for managing and paying off debt so you can live your life.

-

Believe it or not our money is constantly in flux! Maybe you change jobs, move, or separate from a partner? Life circumstances change and impact our money; that’s normal. In Finance Fundamentals, you will gain the tools and knowledge to apply to your changing situations. The plug and play templates and tools are developed to handle any changes in circumstances. Don’t wait to get clarity and calm in your financial picture; the knowledge and tools you gain will help you now and in the future.

-

The client results and five-star testimonials sprinkled throughout this page speak for themselves.

“Life-changing” - Hannah

“100% worth the investment” - Catherine

“I no longer feel physically burdened by financial stress but optimistic and hopeful about the future” - Nora

“I feel self-aware and confident to navigate my finances moving forward” - Megan

and more!

-

Current course members will have the unique opportunity to attend monthly office hours with me! Come and ask any questions! Note: This is a limited time offer so register today to take advantage.

-

Individual coaching is more hands-on with weekly one-on-one sessions. This course is for folks who want to be more self-paced and self-guided. Because it is more self-directed, it is offered at a fraction of the cost of individual coaching sessions. You get all the wisdom and knowledge from the Finance Fundamentals framework and you can tackle the topics and lessons whenever works best for you. It's a win-win!

-

The Founding Member special is only offered to a unique subset of individuals. As a Founding Member, you receive a discounted course price, monthly office hours with Ariel (Founder and Certified Financial Educator) AND you get content paced weekly for Modules 2-4. This a one-time offer so grab it while it lasts! Questions? Email hello@financesforfeminists.com

100% Risk Free

We believe in the quality and effectiveness of our course, and we stand behind it with our 7-day money back guarantee. If you're not satisfied with the course within the first 7 days of your purchase, we'll issue you a full refund less any transaction fees we have incurred.

Simply contact our customer support team within 7 days of your purchase and let us know why you're not satisfied. We'll process your refund as soon as possible.

That being said, don’t be that person who joins, downloads the stuff, and asks for their money back. I’ve yet to see that strategy work. Plus, it’s just bad karma.

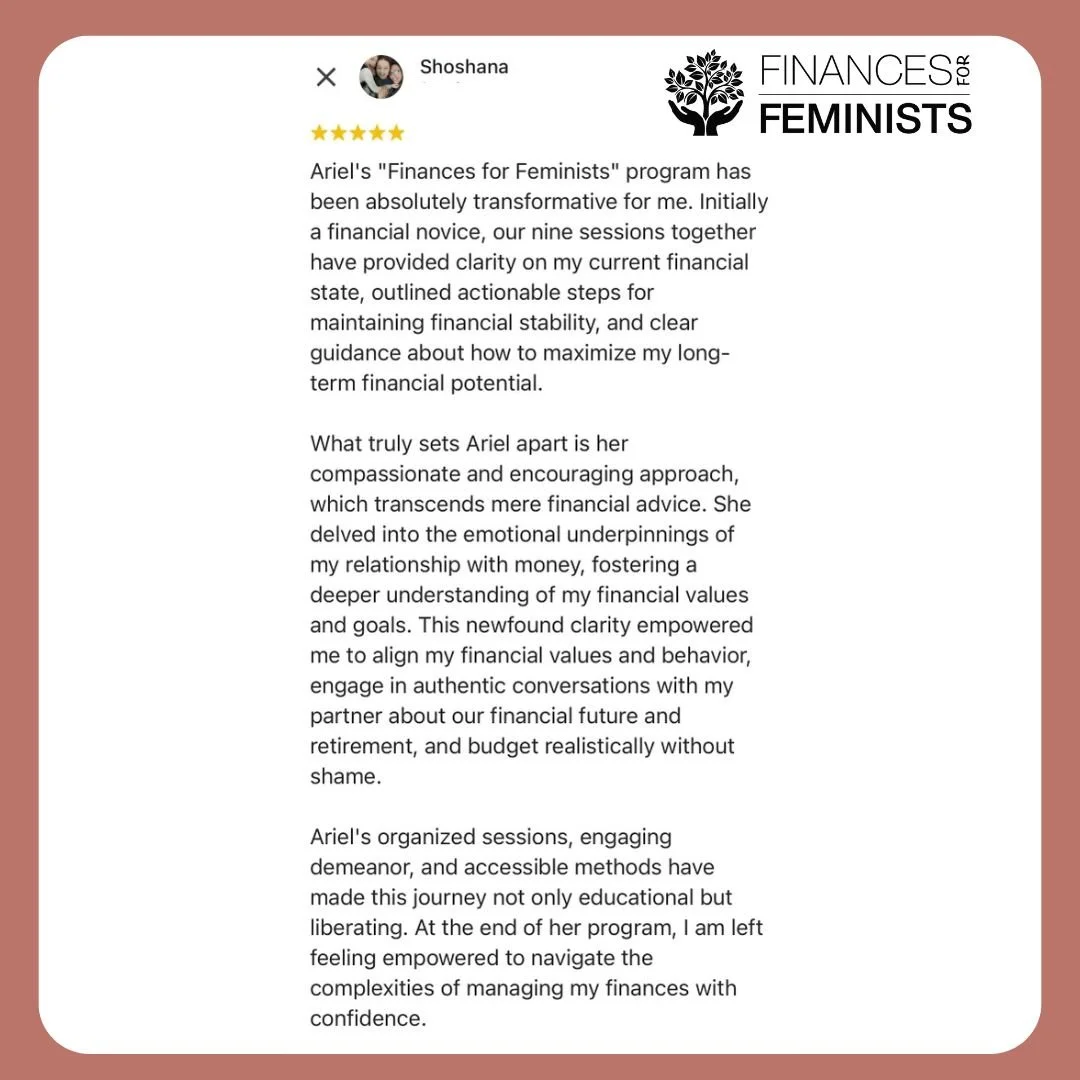

The “[Finance Fundamentals] program has been absolutely transformative for me.”

— Shoshana S.

“[Finance Fundamentals] provided me with peace of mind”

— Genevieve

“100% worth the investment.

I’m amazed with where my financial health is today.”

— Catherine

Disclaimer: Any information presented is educational, not prescriptive. I am not a financial advisor and this information is for educational purposes only.

Nothing on this page, any of our associated websites, social media properties, or any of our content or curriculum is a promise or guarantee of any level of success, proficiency or income future earnings or results. We always recommend using caution and consulting your accountant, lawyer, or professional financial advisor before making any investment decision or before acting on this or any other business or financial information. Basically: talk to professionals before you start investing, recognize that all investments come with an inherent risk, and we don’t guarantee results. Pretty straightforward, right?

Please note lifetime access also refers to as long as the course is in existence.

Legal: Privacy Policy and Terms of Service